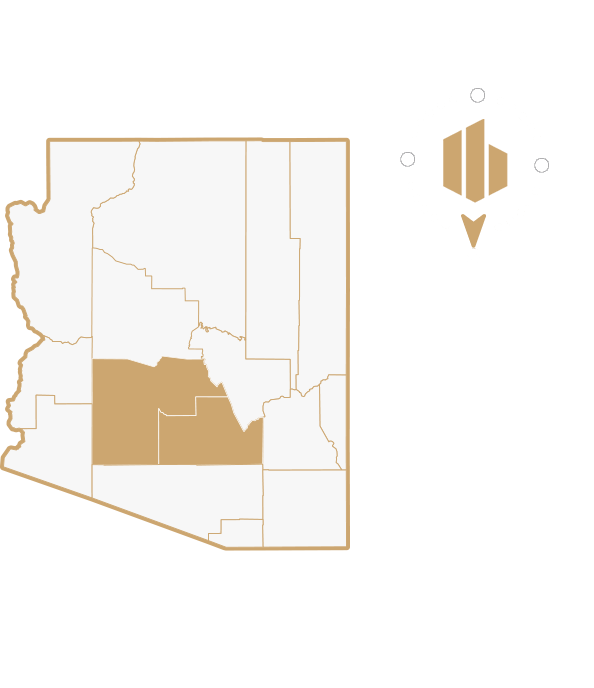

At West Hive Capital, we specialize in revitalizing distressed and value-add retail properties across the Greater Phoenix area. If you know of a property that fits our buying criteria, we would love to hear from you.

Submitting a deal is the first step toward creating a vibrant retail space that benefits the entire community.

With years of experience in Southern California’s retail landscape, we know how to identify and unlock hidden potential.

Our team excels in every aspect of real estate development, from acquisition and design to construction and leasing.

We collaborate with local businesses, leaders, and residents to create spaces that reflect the heart of the neighborhoods we serve.

The national population growth and diverse demographics across the United States contribute to a growing demand for retail spaces, ensuring a reliable stream of potential customers and tenants. Consumers' evolving shopping habits, such as the blend of online and in-store purchasing, continue to drive retail activity.

With office spaces experiencing high vacancy rates and multifamily properties facing compressed cap rates, value-add retail stands out as a more lucrative investment. Retail properties offer better returns and greater flexibility in lease structures.

Value-add retail properties across the country often occupy prime locations in high-traffic areas, from bustling urban centers to suburban hubs, providing a significant advantage in attracting customers and top-tier tenants. This makes these properties attractive for both investors and retailers.

Triple Net (NNN) leases, which are common in retail properties nationwide, mean tenants are responsible for paying property expenses such as taxes, insurance, and maintenance. This structure reduces operating costs for landlords and boosts the net income generated from the property.

Many retail properties nationwide are ripe for redevelopment, particularly as older malls and shopping centers are repurposed to meet current consumer preferences. This presents an opportunity to modernize spaces and improve their appeal, thereby boosting property value and rental income.

Investing in value-add retail properties contributes not only to increased property values but also to the revitalization of local communities. Well-designed and attractive retail spaces can transform neighborhoods, attracting visitors and providing valuable amenities to residents and businesses alike.

As office spaces nationwide face high vacancy rates and multifamily properties experience compressed cap rates, value-add retail properties stand out as a more attractive investment. Retail properties typically offer better returns, higher flexibility in lease structures, and the potential for greater appreciation over time.

Nationwide, retail properties generally exhibit low vacancy rates, particularly in strong markets with demand for shopping and entertainment spaces. This high demand allows landlords to command higher rents, thus increasing the profitability of retail investments across the country.

Reducing crime and improving community spaces.

Creating opportunities for workers and small business owners.

Bringing in stores, services, and restaurants the community actually wants.

Strengthening home values and attracting investment.

General Partner

O: 855.348.5505

C.949.633.6679

kgorman@westhivecapital.com

General Partner

D: 949.269.3231

blehman@westhivecapital.com

Why people trust West Hive Capital

Investment Risk Notice

West Hive Capital specializes in acquiring distressed and value-add commercial properties, which can carry significant risk, including potential loss of all invested capital. Past performance is not indicative of future results, and cash distributions are not guaranteed.

Accredited Investor Requirement

West Hive Capital’s offerings are available to accredited investors only, as defined by Rule 501(a) of the U.S. Securities Act of 1933. Prospective investors should carefully consider their risk tolerance and financial situation before investing.

Forward-Looking Statements

Certain statements on this website may include forward-looking information that reflects our current expectations. These statements are subject to risks and uncertainties that could cause actual results to differ materially.